Dividends

Home » Dividends

Latest dividend

| 2024 interim dividend | 16.5 cents per share, fully franked |

|---|---|

| Ex-dividend date | 16 February 2024 |

| Dividend record date | 19 February 2024 |

| Last election date for DRP & DSSP participation | 20 February 2024 |

| Payment date | 8 March 2024 |

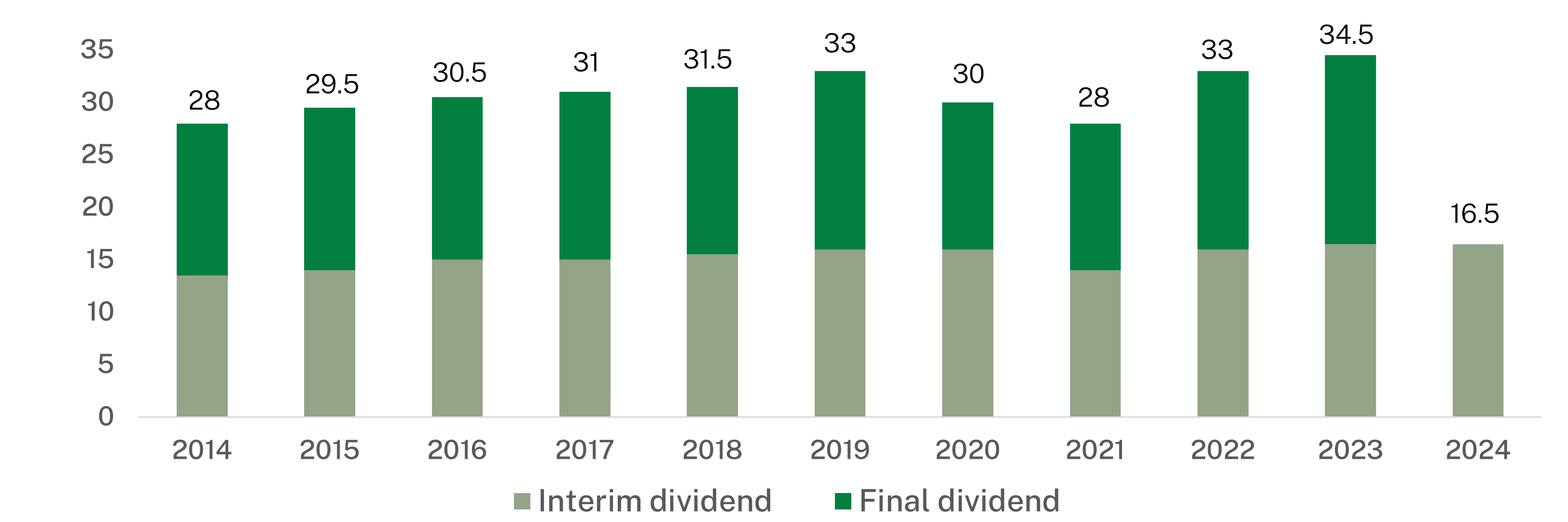

Our dividend track record

Annual dividends paid (cents per share)

So far this financial year, only the interim dividend has been declared.

Dividend Reinvestment Plan

Argo’s Dividend Reinvestment Plan (DRP) allows shareholders to automatically reinvest their dividends into additional Argo shares, instead of receiving cash dividends. Shares issued under the DRP do not incur brokerage or other transaction costs. Shares issued under the DRP do not incur brokerage or other transaction costs.

Participation

Shareholders can choose to participate in the DRP with respect of all or part of their Argo shareholding, and can vary their level of participation or withdraw from the DRP at any time.

To participate in the DRP, or amend DRP participation, shareholders can update their own instructions online via the share registry’s online portal InvestorServe or contact the share registry.

More information

For more information, see the DRP Information Memorandum and Terms and Conditions here.

Dividend Substitution Share Plan

Argo’s Dividend Substitution Share Plan (DSSP) is an optional method by which eligible shareholders may receive additional Argo shares as an alternative to receiving dividends. Shares issued under the DSSP do not incur brokerage or other transaction costs.

Where a shareholder forgoes a dividend which would otherwise be franked, the shareholder will not be entitled to a ‘franking credit’ as the shareholder has not received a franked dividend. Specific taxation advice should be obtained by participants.

Participation

Shareholders can choose to participate in the DSSP with respect of all or part of their Argo shareholding, and can vary their level of participation or withdraw from the DSSP at any time.

To participate in the DSSP, or amend DSSP participation, shareholders can update their own instructions online via the share registry’s online portal InvestorServe or contact the share registry.

Historical dividends

For details of dividends paid by Argo since 1986, including payment dates and franking amounts, click here.

LIC capital gains tax deduction

In addition to the benefit of franking credits, dividends may include a listed investment company (LIC) capital gain component which allows a tax deduction for most shareholders.

More information

For more information, including how to claim the tax deduction, see our LIC capital gain tax deduction fact sheet here.